Regulatory standards, depending on your reading of the latest IRS Tranches and guidance, have either changed or come into clearer focus when it comes to what the CDFI Fund identifies as a "successful" Opportunity Zone (OZ) project. Regardless of your reading of IRS's latest missives, there are a few tactics worth highlighting that will ensure that the economic impact analyses describing the significance of your projects and the potential economic significance of your program (or portfolios) will stand ready for review when the time comes to evaluate their contribution to the economic well-being of your service area.

When it Comes to Opportunity Zones, Geography Matters

Starting Broadly

Generally speaking, the larger the study area in the analysis, the larger the impacts are going to be. However, that isn’t always the case.

First, the ripple effects that add up to the total impact depend upon several factors:

- The initial industry of the Qualified Opportunity Zone Property or Business (“QOZP” or “QOZB”)

- How much in inputs (resources) that industry needs to buy

- What quantity of those inputs can be locally sourced

- If the industry’s production requires a lot of workers who earn a lot of money

- Where those workers spend that money (are they in-commuters to the study region or are they local?—a fundamental factor in qualifying for funds or allocations)

Geography is an important (and sometimes shifting) variable. Thus, the aggregation of these factors is essentially why an impact analysis constrained to one geography will have a different impact compared to another similar geography.

Aside from the factors above specific to the location of workers and businesses, economic data—the sort upon which IMPLAN is based—accounts for regional idiosyncrasies that affect the output or potential contribution to GDP that an industry may generate in a particular part of the country.

For example, an employee of a firm in the legal services industry in New York County, New York would likely receive a greater per annum than a similar worker in the same industry employed in Loving County, Texas. This difference is especially visible when comparing smaller geographies such as counties or metropolitan statistical areas (or cities) to each other.

Getting Specific

OZ’s, which are based on census tracts that are generally much smaller than a zip code, often prove statistically scant when it comes to modeling the economic impact of a project. But don’t just take my word for it:

“The first thing you have to do is you have to set the economic context for your zones at the city or metropolitan scale… what are the major driving sectors, employers in your given city or metropolitan area. Zones don’t exist in the abstract. They’re part of an ecosystem of an economy.” —Bruce Katz, Nowak Metro Finance Lab

The best approach to modeling the economic impact of a project to its “local economy” is to start with the predetermined census tracts defined in the OZ requirements. Next, establish the zip code(s) that make up the local neighborhood of that OZ which will serve as your direct impact area.

The key to building an economic model for these scenarios in which you need to restrict impacts to the OZ, see those impacts extended effects to the local community (especially when applying for construction permits with local municipalities), and estimate ripple effects to a state or the entire country is to employ an economic modeling technique known as multi-region input-output analysis (MRIO).

MRIO allows you to specify a direct impact region within which the primary business activity is taking place and measure its local effects while also tracing the trade flow between your primary region and additional secondary regions. This will give you economic impact results specific to your project’s neighborhood as well as the surrounding areas.

Don’t Worry—There’s Help

In addition to working with an accomplished tax consultant, you can find a great deal of help with framing an economic impact analysis of your own from a host of readily-available guides and handbooks which are honored and sometimes published by federally-regulated agencies. Here are our top picks:

- The Environmental Protection Agency’s Guidelines for Preparing Economic Analyses

- U.S. Department of Transportation’s Economic Analysis Primer

- UNESCO’s Measuring The Economic Contribution Of Cultural Industries

- National Institute of Standards and Technology’s Methods for Assessing the Economic Impacts of Government R&D

- Taylor & Francis Group’s Economic And Fiscal Impact Assessment

- State of California Department of Water Resources Economic Analysis Guidebook

- USDA’s “A Practitioner’s Guide to Conducting an Economic Impact Assessment of Regional Food Hubs using IMPLAN: a step-by-step approach”

- Forest Service Handbook, Evaluating Economic Efficiency

- Illinois Public Health Institute’s Critical Analysis of Economic Impact Methodologies

- Economic Development Research Group’s “Measuring Economic Impacts of Projects and Programs”

Prepare Your Exit Strategy

As the years roll on for your projects, so too does the collection of new economic data from myriad government and publicly-available sources. These data capture the changes in the zip codes, counties, and broader economic landscapes which surround the OZs that house your project. This means that as your project portfolio creates economic lift for properties and business, its impacts are quantified (although anonymously) in every year’s data set. Fortunately, there’s a way to peer through the complexity of the data to trace the correlations between your projects and their effects on the economy.

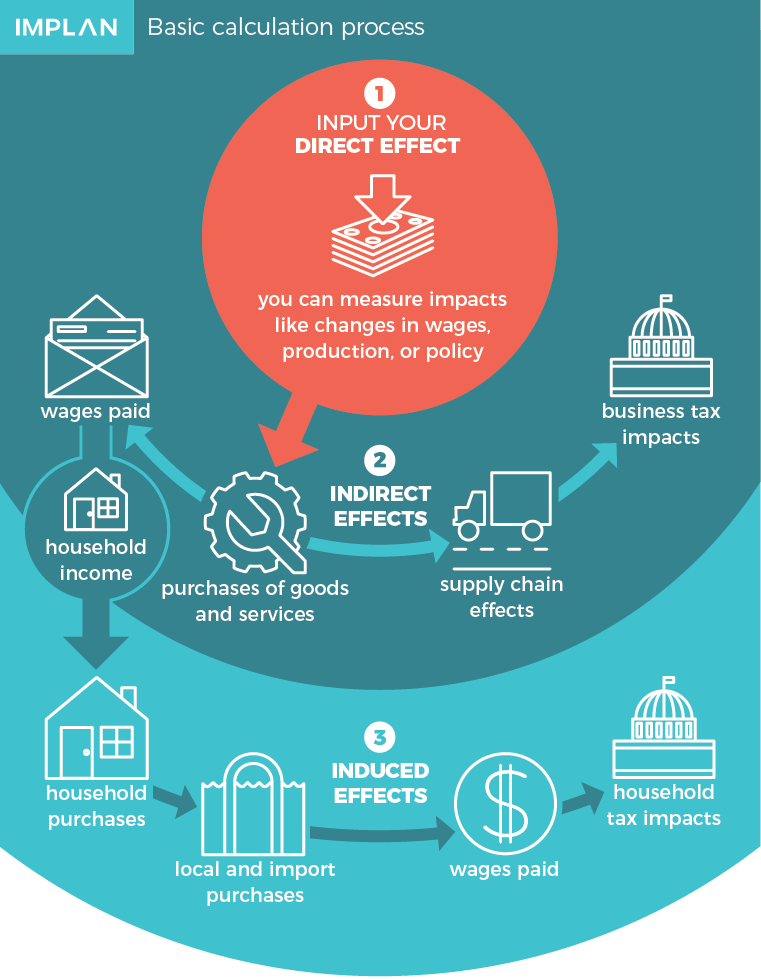

Contribution analysis is an economic modeling methodology which accounts for not only the business activity of a given industry in its host economy, but also traces the indirect and induced effects like jobs supported and total taxes contributed as a result of that business activity affecting the spending patterns of other businesses and households within the study region.

Take, for example, the Economic Contribution of Alomere Health: A Report of the Economic Impact Analysis Program from the University of Minnesota Extension Office. The Alomere Health System, consisted of two general medical and surgical hospital with two clinics. In order to meet increasing demands, Alomere funded an expansion project through a variety of public and private sources. The extension office tracked the attributable changes in the local economy of Douglas County, MN between 2012 and 2017. In 2017, it contributed an estimated $291.4 million in economic activity to the state. This included $122.3 million in labor income and created 740 new jobs while supporting 1,095 jobs.

Projected Total Annual Economic Contribution of Alomere Health’s Operations, 2018, Minnesota

|

|

Direct |

Indirect |

Induced |

Total |

|

Output (millions) |

$147.0 |

$95.8 |

$53.8 |

$296.6 |

|

Employment |

740 |

715 |

380 |

1,835 |

|

Labor Income (millions) |

$57.9 |

$46.3 |

$18.4 |

$122.6 |

Wrapping it Up

Contribution analysis can also surface details as specific as state and local or federal taxes contributed as a result of annual operations. These tax contributions offer a clearer window into the economic ROI of a project’s years of construction and/or operations—and signify which types of projects best satisfy the spirit of the tax incentive legislation.

Issues about program oversight have been raised since the The Community Renewal Tax Relief Act kicked off more than a decade ago when the legislation’s first incarnation was passed in 2007. What we’re seeing now is a season of stronger accountability as the law’s daughter initiatives have entered their teenage years.

Why Economic Impact Analysis is Important for Your QOF

- Reporting your Qualified Opportunity Fund's (QOF) progress with its social and economic goals in an investor meeting or quarterly report is something that an economic impact analysis can help deliver. The practices of “sustainable investing” or “impact investing” have grown in recent years as more and more mission-driven investment entities seek ways to ensure that their ideological and revenue goals are consistently met.

- Impact analysis can be an extremely powerful tool to get local government to approve and support your projects. One of the most convincing insights that modeling the impacts of your investment can give you is the number job-years your project will support in existing businesses within communities. Some state and local governments, including Oregon, explicitly state that one of the criteria included in the approval process for new projects is the number of new jobs created and jobs supported.

- Earlier this month four senators endorsed a bill which will specify how compliance and success is measured for OZ-based projects. "When we passed tax reform, I was proud to support the creation of Opportunity Zones to incentivize new investment in distressed communities across the country," Senator Young (R-Ind.) said, "Our bill will help strengthen Opportunity Zones by increasing transparency within the program and creating metrics to measure and improve on its success." Economic impact analysis is already familiar to Congress and is built in to existing regulatory legislation so it stands to reason (especially since the Economic Innovation Group think tank has been involved in advising on drafts of the bill) that economic impact analysis will play a role in evaluating OZ projects.

As more projects and eligible businesses approach the maturation of their funding and tax incentive programs, more and more compliance issues will come to the fore. Establishing and maintaining a rock-solid economic impact and economic contribution methodology will prove instrumental to maintaining a strategic foothold and ensuring the long-term success of your investments.

.png?width=80&name=IMPLAN_Logo_Print-Vector_NEW%20(2).png) Copyright 2025

Copyright 2025